CAN A FELON OPEN AN IRA

In the complex financial world of securities and investments, planning out a strategy for retirement is already a challenging feat for the “regular” Joe and Jane – so you can imagine how much more stressful this will all be for Joe and Jane when they have a felony conviction on their record.

After all, we felons know that things will not be easy, and life has a way of taking plenty of opportunities away from us, that would have normally otherwise been “applicable” had we not had this little hiccup (felony) to contend with.

This not only pertains to finding employment or making a stable income, but also extends to the realm of individual long-term saving options such as Individual Retirement Accounts (IRAs).

This post examines the eligibility of convicted felons when it comes to opening an IRA, and ventures to explore the existing laws and regulations associated with eligibility, and if a felony conviction has any sway over a person’s capability to open such an account.

Eligibility Requirements for IRAs

Is it really so far-fetched and/or even stupid to ask such a question that IF A FELON CAN OPEN AN IRA? as many ordinary people out there would laugh and say of course they can, why would they not be able to?

Well, let me explain something; when you are a felon, things get stripped away from you, such as:

- Rights

- Opportunities

- Options

- Security

- Freedom

- Pride

- Dignity

- Confidence

These are all things that impact your quality of life, and although it may seem redundant, it is not. For the average person out there, they generally have full access to all of these inherent things. For the plight of the convicted felon, sadly, they are lost.

Simple things such as voting rights, job security, and the ability to obtain life insurance in order to provide for your family in the event of your demise.

Click Here if you would like to learn more on if a convicted felon is able to secure a life insurance policy.

The world of personal finance and retirement planning can often seem like an absolute maze, for anyone, particularly for individuals with a felony conviction. Yet there is a common misconception that having a criminal record restricts and impacts eligibility for Individual Retirement Accounts (IRAs).

You may also want to check out CAN A FELON GET A MORTGAGE TO BUY A HOME?

There is a critical need for clarity on this topic, as understanding this concept can be empowering, liberating, and enables better choices towards building a secure financial future. More importantly, we ask the main question we are interested in….

CAN A CONVICTED FELON OPEN AN IRA?

Yes, a convicted felon may obtain an IRA, as a criminal record does not directly affect an individual’s ability to open or maintain an IRA. The Internal Revenue Service (IRS) has no stipulations in its regulations that render a convicted felon ineligible to establish an IRA. Therefore, regardless of their criminal record, anyone with earned income can contribute to an IRA.

It is crucial to remember, however, that a felony conviction might indirectly impact IRA eligibility, as it predominantly revolves around factors such as steady employment and generating an income.

Moreover, it is essential to note, that in many cases, a criminal conviction could potentially result in a fine, forfeiture, or restitution, all of which could subsequently impact the availability of funds for saving and investing. While a felony conviction does not obstruct the possibility of investing in an IRA directly, these consequences can represent roadblocks to putting away and contributing funds towards the retirement account though.

Hence, for those having to bear the brunt of a felony conviction, sage advice would be to focus your concentrated efforts towards obtaining steady employment and income in order to feed that IRA account on an ongoing basis.

In the spirit of the entrepreneurial mindset, individuals have been known to overcome past felony convictions by launching a business and turning a new chapter in life, thus taking advantage of this investment tool to help shape their financial future.

Retirement Planning and Being a Felon

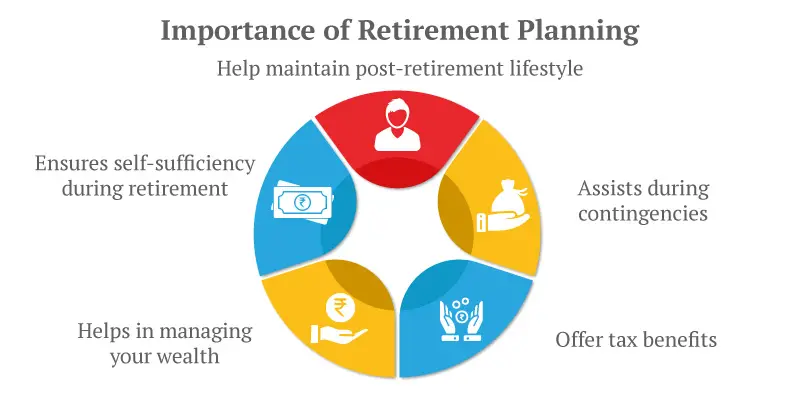

Amid all of the obstacles that a felon will face after serving their time, understanding and leveraging financial opportunities is an invaluable skill. Closely linked to the reintegration process, financial planning and management is critical for establishing a better quality of life post-incarceration.

This calls for focus, determination, and patience in order to develop strategies in order to overcome the challenges that exist alongside available opportunities.

One such opportunity, post-incarceration, springs from business building. Entrepreneurship often acts as a lifeline for those overlooked by traditional employers – a reality convicted felons will face (everyday).

Many successful entrepreneurs have forged this difficult path, proving its viability. A felon can and may harness the transformative power of entrepreneurship and, with smart financial management, achieve growth and security.

By starting a business, felons can provide valuable jobs in their communities, and create additional sources of income that can be invested wisely for continued financial growth. However, you must also realize there will be setbacks and loads of rejection to endure going down this path.

CONCLUSION

When analyzing the financial opportunities available to someone with a felony, the first notion is to acknowledge the situation as that of somewhat hopeless and bleak. After all, things (especially finances) are already difficult for many out there, let alone the individual with a criminal record.

But by taking a serious look at the potential of going into business for yourself and becoming an entrepreneur, felons are strongly positioned to partake in the investment tools available to forge a new, economically stable life and retirement.

– The Educated Felon