Locked Up for Being Broke: The Alarming Comeback of a Prison for Debtors

Did you know that in 21st-century America, you could end up behind bars simply for being unable to pay a debt? It sounds like a plot from a Charles Dickens movie, but it’s a startling reality for thousands of Americans each year. Let’s look at some shocking statistics:

- As of 2020, courts in 26 states had issued arrest warrants for debtors unable to pay fines and court debts

- Some states are arresting thousands of people annually over unpaid court fines and fees

- A 2018 study found that 45% of all booking events in local jails were related to failure to pay court fines or fees

- In certain jurisdictions, up to 20% of jail inmates are there because they couldn’t afford to pay their debts

Welcome to the modern world of debtor’s prisons – a practice many thought was long abolished, yet continues to haunt our criminal justice system. These numbers paint a grim picture of a justice system that often punishes poverty as much as it does crime.

The Return of a Dark Chapter in History – The Debtors Prison

Debtors prisons might seem like a relic of the past, conjuring images of Victorian-era England or the early days of American colonization. However, modern-day debtors prisons have found new life in our legal system, often hiding behind different names and legal loopholes. But what exactly is a debtors prison, and how do courts continue to allow it to persist in today’s society?

What Is a Debtors Prison?

A debtor prison, in its simplest terms, is a system where individuals are incarcerated (serve jail time) for failure to pay their court costs and debts. While the concept may seem straightforward, its modern incarnation is far more complex and insidious.

Key Aspects of Modern Debtors’ Prisons:

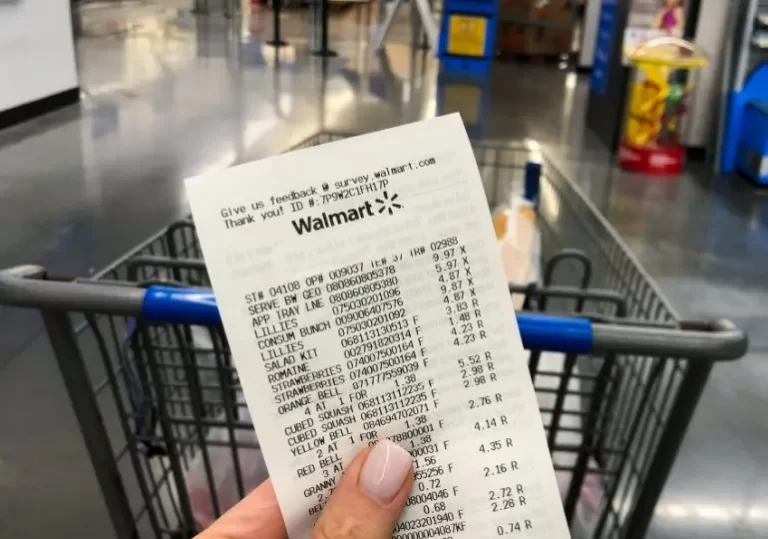

- Court Fines and Fees: Often, imprisonment stems from an inability to pay court debts, unpaid fines, fees, or restitution.

- This includes costs for public defenders, court administration, and even jail stays.

- Fines can quickly snowball with late fees and collection costs.

- Some jurisdictions use private companies to collect debts, adding additional fees.

- Failure to pay fines and fees can result in driver’s license suspension, making it harder to work and pay off debts.

- Civil Debts: In some cases, people are jailed for failing to appear at debt-related hearings or for contempt of court in civil debt cases.

- Creditors can request “debtor’s examinations” to determine a person’s ability to pay.

- Missing these hearings, even if unintentional, can lead to an arrest warrant.

- Some judges use incarceration as a way to coerce payment, even when debtors truly cannot pay.

- Medical debts, credit card bills, and even unpaid rent can lead to court summons and potential jail time.

- Bail Systems: The cash bail system can effectively create a debtors prison for those unable to afford bail.

- People who can’t afford bail remain in jail while awaiting trial, even if innocent.

- This can lead to job loss, eviction, and further debt, creating a vicious cycle.

- Some jurisdictions use bail schedules that don’t account for individual financial circumstances.

- Commercial bail bondsmen profit from this system, often at the expense of low-income defendants (poor people).

- Probation Fees: Failure to pay probation fees can result in re-incarceration.

- Many jurisdictions use private probation companies that charge fees for supervision.

- The inability to pay these fees can be deemed a probation violation, leading to jail time.

- Some probation terms require payment of fees before other court-ordered programs can be completed.

- This creates a “pay-to-play” justice system where poorer individuals struggle to complete probation successfully.

The Numbers Tell a Grim Story for a Debtors Prison

To truly grasp the scale of this issue, let’s look at some data:

| YEAR | Number of States with Debt-Related Arrests | Estimated Annual Arrests |

| 2010 | 15 | 5,000 + |

| 2015 | 20 | 10,000 + |

| 2020 | 26 | 15,000 + |

| 2024 | 28 | 20,000 + (Projected) |

This trend shows a disturbing increase in both the prevalence and scope of debt-related incarcerations across the United States.

A Real-Life Example of Debtors Prisons

Meet Sarah, a single mother of two from Ohio. After receiving a speeding ticket she couldn’t afford to pay, Sarah found herself trapped in a cycle of escalating fines, fees, and eventually, jail time. Her initial $150 ticket ballooned to over $1,000 with late fees and court costs. Unable to pay, she was arrested and spent three days in jail, losing her job in the process. Sarah’s story is not unique – it’s a reality faced by thousands of Americans each and every year.

True or False: Debtors Prison Edition

Test your knowledge with these true or false statements:

- Debtor’s prisons were officially abolished in the United States in the 1830s.

- True. Federal debtor’s prisons were abolished in 1833.

- It’s illegal to imprison someone solely for failing to pay a debt.

- True. However, people are often jailed for contempt of court or failure to appear, which can be related to debt.

- Only criminal fines can lead to imprisonment for debt.

- False. Civil debts can also lead to arrest warrants and jail time in some jurisdictions.

- The Constitution prohibits imprisonment for debt.

- False. The Constitution doesn’t explicitly prohibit it, though some argue it violates the 8th Amendment.

Frequently Asked Questions

- Q: Are debtor’s prisons constitutional? A: While explicitly outlawed, practices amounting to debtors prisons persist through legal loopholes.

- Q: Can you go to jail for credit card debt? A: Directly, no. However, failing to respond to court summons related to debt can lead to arrest.

- Q: How can I avoid debtor’s prison? A: Stay informed of your rights, respond to all court summons, and seek legal aid if facing debt-related legal issues.

- Q: What’s being done to stop this practice? A: Various organizations such as the ACLU (American Civil Liberties Union) and some legislators are working on reforms to end de facto debtor’s prisons.

Closing Thoughts: A Call for Change to a Prison For Debtors

As we’ve seen, the concept of “prison for debtors” is far from a historical footnote – it’s a pressing issue in our modern justice system.

From court fines to civil debts, how financial obligations can lead to incarceration are numerous and often obscure. This practice not only violates basic principles of justice but also perpetuates cycles of poverty and incarceration that can devastate individuals, families, and communities.

The persistence of debtor’s prisons in 2024 serves as a stark reminder that our journey toward a truly equitable justice system is far from complete.

As citizens, we must stay informed, advocate for change, and support reforms that prioritize rehabilitation and fairness over punitive measures that disproportionately affect the most vulnerable among us.

Remember, in a just society, your freedom should never come with a price tag. Let’s work together to ensure that “prison for debtors” becomes a true relic of the past, not a modern-day reality.